HCMC, Nov 10th, 2018 – PetroVietnam Fertilizer and Chemicals Corporation (PVFCCo – securities code DPM, Phu My fertilizer producer and trader) said that from July 23, 2018 to September 9, 2018, the Taskforce of the State Audit of Vietnam (SAV) worked at PVFCCo and member units. During the work process, the State Audit completed the audit and issued the Report on audit of Financial Statements and activities related to management and use of the State capital and assets of PVFCCo in 2016- 2017.

One of the key points in the audit process at PVFCCo was the figures of revenue, profit before tax and profit after tax. According to the announced independently audited financial statements of PVFCCo for 2016 and 2017, these figures were VND8,170 billion, VND1,393 billion and VND1,165 billion (2016); VND8,178 billion, VND853 billion and VND708 billion (2017) respectively. According to the audit results of the State Audit of Vietnam, these figures were VND8,711 billion, VND1,400 billion and VND1,167 billion (2016); VND8,187 billion, VND1,052 billion and VND895 billion (2017) respectively.

Revenue figures for 2016 and 2017 on the independent audit report were not much different from the figures by the State Audit. The profit before tax and profit after tax in 2017 according to audit results of the State Audit increased by VND199 billion and VND187 billion respectively compared to results of independent audit, mainly due to some reasons related to the internal transactions as follows:

-

As some overall maintenance costs were incurred at the end of overal maintenance period on December 31, 2017, the parent company did not record these costs as a decrease in cost in the Financial Statements 2017 (VND 111 billion). The parent company has recorded an increase of asset in the 9-month Financial Statements 2018.

-

The actual overall repair and maintenance costs that were decreased by VND43 billion compared to estimated amount caused a decrease in the respective cost. The parent company recorded reversal of repair costs in the 6-month Financial Statement 2018.

-

The selling costs reduced by VND9 billion due to re-allocation of transport expenses for the year-end inventories.

-

Overhead costs reduced by VND23 billion due to re-classification of some items of salary expenses; reversal of some accrued expenses and re-allocation of tools and instruments in parent company and subsidiaries.

The State Audit of Vietnam required PVFCCo to review a number of internal transactions in the financial and accounting work in order to timely reflect these internal transactions in the accounting period, particularly to adjust figures on accounting books and financial statements in 2016, 2017, simultaneously paying additional CIT of VND17 billion due to changes in business performance.

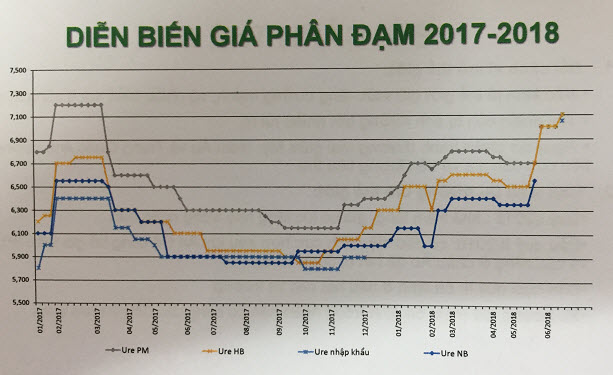

The audit process also showed that PVFCCo’s business operations and management was transparent and gave a true and fair view of business performance when the prices of natural gas (input materials for production) increased while the output (fertilizer) prices were affected by the world prices, although Phu My Urea prices were always higher than those of the products of the same kind. With the conclusions of the State Audit, PVFCCo management said that they would seriously acquire and implement the recommendations of the State Audit to improve its operations.

.jpg)