Securities Investment Review, 06 May 2020

In the latest annual report, Mr. Nguyen Tien Vinh, Chairman of PetroVietnam Fertilizer and Chemicals Corporation (PVFCCo – HSX: DPM) particularly addressed that, PVFCCo, on the whole, has successfully wrapped up 2019, overcame multiple unexpected challenges and difficulties, continued to stay on the lead in the industry with reforms in structure and approach to kick off a journey filled with fresh spirit and new expectations.

PVFCCo has always been one of the leading enterprises in the field of oil processing, especially fertilizer.

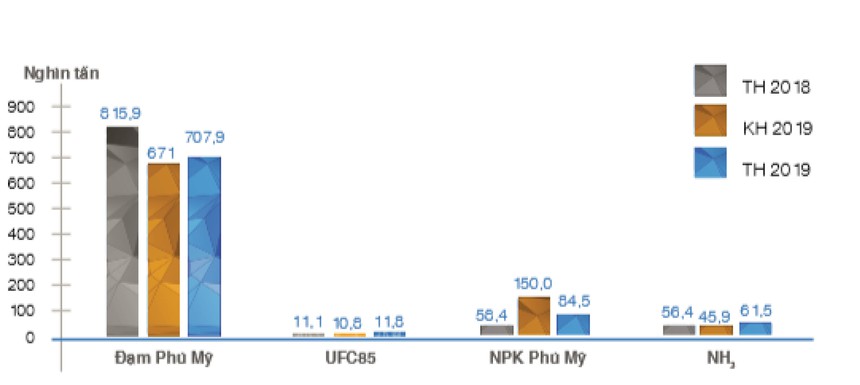

In 2019, Phu My Fertilizer Plant maintained stable and efficient operation, produced 708 thousand tons of urea, exceeding 6% of the plan.

Production of fertilizer and chemicals in 2019.

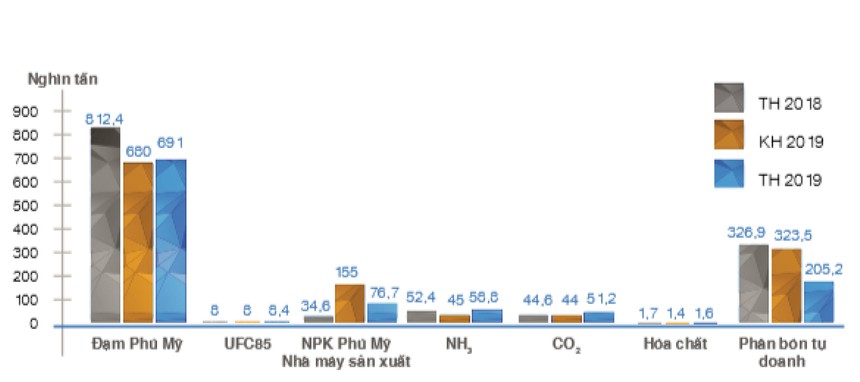

Sold quantity of fertilizer and chemicals in 2019.

Although the sales were lower than planned, 2019 remained a prosperous year of PVFCCo when profit exceeded the plan, regarding the fact that the company had to overcome difficulties arising in production, while also facing external disadvantages related to gas delivery costs (increasing by over 40% compared to 2018), the agriculture sector and fertilizer market were adversely subjected to climate change, the price sharply declined after the recovery phase since the fourth quarter of 2018.

Over the year, PVFCCo has dynamically restructured the governance system in order to form a new streamlined and more efficient management structure on the ground of promoting a foundation of experienced staff, innovative governance system, extensive distribution system, and a leading fertilizer brand in the market.

In addition, the Board of Directors focused on asset management activities, lowering management and sale costs so as to carry on with the modification of the Corporation's overall performance.

The market recognized and voted PVFCCo as a member of the large, transparent and efficient listed enterprises group.

With great efforts in managing and operating the production-sales in 2019, the market recognized and voted PVFCCo as a member of the large, transparent and efficient listed enterprises group: PVFCCo is one of the 150 largest businesses in Vietnam; one of the 50 most outstanding listed companies in 2019; in the Top 50 leading brands in Vietnam; Top 5 companies with the best corporate governance in Vietnam; Top 3 listed companies most favored by investors for IR; etc.

Entering 2020, PVFCCo clearly identifies the missions and goals to achieve as well as the risks and challenges that affect the growth of the Corporation in the upcoming period.

The key goals for 2020 set by the Corporation are: maintaining the efficient operation in the existing fertilizer and chemical plants (especially NPK plants); utilizing the favor of the competent authorities to achieve short-term and long-term commitments on the abiding source and input price of gas, securing sustainable growth; increasing sales and market development activities to diversify the consumption sources for fertilizer and chemical products;

Furthering the research and development of new products in a focused manner, sticking to the market and customers; last but not least, continuing to perfect the governance structure – professional operation, enhancing governance competence, information transparency to adapt to competitive environment and the ups and downs of the market.

2020 is the beginning of a new decade, a new phase on the new path of growth of PVFCCo.

The objectives of development strategy reviewed and updated in the upcoming time will soon be planned, the newly shaped face of the comprehensively restructured governance system will create a powerful momentum for the new path of growth.

The chart of production structure and product volume contributing to the 2019 revenue shows that not only Phu My urea, but other fertilizers and chemical products also account for an increasing proportion of PVFCCo's total revenue.

According to the financial report of the first quarter of 2020, net revenue within the period of PVFCCo rose by 8%, reaching 1,697 billion dongs and gross profit grew by 26%, reaching 339 billion dongs; gross profit margin increased from 18.2% to 20%; Phu My urea sales volume rose by 46% over the same period, accordingly boosting the revenue.

Besides, the price of gas being the main input material of PVFCCo products declined compared to the same period, accordingly lowering the product cost.

Moreover, financial revenue in the period doubled to 31 billion dongs, and corporate governance costs decreased.

On the other hand, sales expenses increased by 39 billion dongs, proportional to the quantity of sold goods. The hereabove optimistic occurrences helped the profit after tax almost double over the same period, reaching 106 billion dongs, attaining 25% of the target profit for the whole year round.